Jamaica’s newest financial house, Sygnus Investments, is led by three talented and innovative businessmen who have made it clear that their aim is to revolutionise how businesses raise money in capital markets, facilitate mergers and acquisitions, and provide advisory services for tax planning and estate planning in Jamaica and the Caribbean.

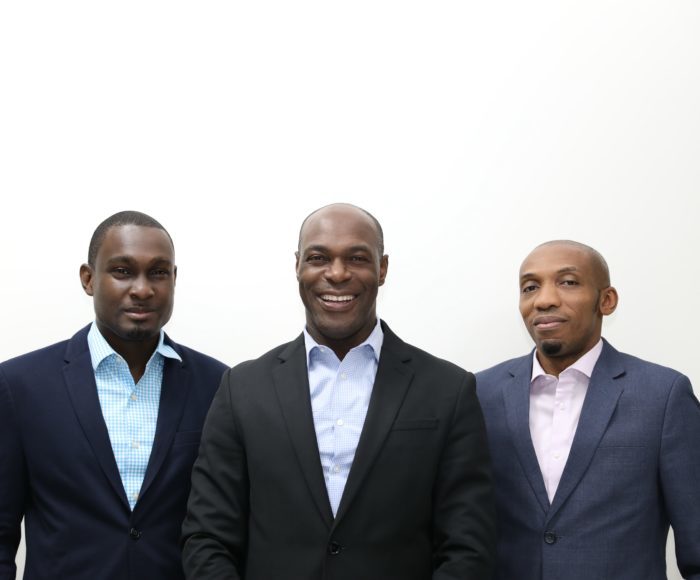

The Jamaica Observer sat down with the men of Sygnus — Chief Executive Officer Berisford Grey, Chief Operating Officer Ike Johnson, and Chief Investment Officer Jason Morris — to hear their stories. We wanted to find out about their beginnings and their journey up to this point.

This is the first part of an interview in a two-article series. We start with Berisford Grey.

Where are you from?

“Brown’s Town, St Ann, [where I went to] York Castle High. I then went on to attend Kingston College, and then The University of the West Indies.”

What was your first Job?

“A bank teller at Scotiabank … Scotia Centre.”

What has your career journey been up to this point?

“My career really started in Europe. After leaving the UWI with a master’s degree in economics, I moved to Europe with the intention of pursuing a PhD in Financial Economics. Being in Europe got me exposed to the investment banking world, and in one year I decided I wanted to become an investment banker.

“At that time it was very difficult, it was a very competitive sector. Not being European and having to deal with visas made it quite challenging. Most jobs offered to me were regulatory jobs, such as in the Bank of England, Financial Services Authority in the UK. But I waited and then got my first job in investment banking with a Swedish firm called Fredell & Company Structured Finance.

“The unique thing about them — I’m a bit indebted to them — is that they focused on securitisation and any type of highly complex transactions… such as asset-backed securities, mortgage-backed securities, corporate load obligations, corporate debt obligation, leverage buyouts, debt buyouts. At that time the securities market was booming; everyone wanted to get into either securitisation, private equity, or the equity desk on technology stock — because that was the start of the Internet bubble… so I was really lucky to get into the field.

“The biggest benefit in that field was that it developed a lot of creativity in me, in terms of how you structure financing and think about solving financial problems. It also helped me to become much better at sales and execution, to become more creative, to become more aggressive at sales and execution.

“At the end of the day, I think that laid the foundation for my whole career.”

After leaving Europe, Grey joined CIBC FirstCaribbean as an associate director at the age of 30, brimming with vision and a passion for investing.

“They wanted to build out their capital market business,” he explains, adding that he spent six years and helped them to do just that.

“There, I was able to contribute significantly to what I think, at the time, was the number one investment shop in the region.”

When he left in 2010, he was the director of capital markets for the northern Caribbean.

In 2010 he moved on to Scotia, where his main job was to help do what he did at CIBC FirstCaribbean: build out their capital markets. In the three years he spent there, Scotia became the number one investment banking house in Jamaica in terms of volume of deals. However, Grey points out that he was certainly not the only person responsible for this accomplishment, and lauds his colleagues and the great team that was in place.

“I was then recruited to CIBC FirstCaribbean again, but now for a different mandate — this time to help drive growth in the company, as they had just gone through the crisis and growth was flat. So my job was to help drive growth in both the corporate and investment banking business.”

There he spent another three years where he helped rebuild the corporate banking and investment banking team, and “worked closely with the executive team to get back the bank into a strong shape”.

He was again promoted, this time to the position of managing director of corporate and investment banking at CIBC FirstCaribbean.

“The good thing is that when I left, the bank had turned around significantly. I can’t take credit for everything, but by working together the bank was now making billions in deals.”

He subsequently left this post to start his entrepreneurial journey in January 2017.

“Even when I left Scotia to rejoin CIBC, I knew that my next project would be an entrepreneurial project. So I knew that my time at CIBC would be my last job within a large, corporate organisation.

“Each one of these experiences has prepared me for this new entrepreneurial journey.”

What does he bring to the Sygnus table?

He brings his vast investment banking knowledge, as well as strategic and executive leadership skills.

However, he stresses that even more than his qualifications, one common thread that links him and his other co-founders “is a strong drive and an ability to be persevering and relentless”. They each experienced many challenges and disappointments, took them in stride, and kept moving resolutely towards their ultimate goal.

Grey is also a strong team player.

Where does he see Sygnus five years from now?

“Our goal in five years is to be the leader in the nontraditional space, and that space includes using companies such as Sygnus Credit Investments to expand and grow what you call the private credit investment market and other forms of nontraditional financing.

“We also envision our other business lines, such as our investment banking business, to be a dominant player in the mergers and acquisitions space especially.

“That’s an area that we believe we have the skill set and experience to really help companies across the region, in terms of buying and selling companies and creating the right value for new or existing owners.

“On our other business lines, such as our international portfolio management business, that’s an area where we expect again to be a dominant player, where we help clients — true to our philosophy — to access international investment opportunities and managing their portfolio to generate returns. Sygnus should, at that point, be best in class in terms of what we give to customers, in terms of value and international portfolio management.

“Our final business line, which is our tax advisory — and we are the only finance firm in the Caribbean that does this — we expect that business to be similar to the other business lines and to be the dominant advisory business right across the region, in terms of helping companies with tax compliance and creating tax efficiency for companies.”

“In a nutshell, Sygnus’s goal is to be the leading, non-traditional financing firm in the region, and that basically means that we… become the dominant player in our three lines of business.”

What is the company’s message to potential customers?

“It all goes back to the four pillars and value propositions the business offers. We will offer the customer an independent way of thinking, put the customer first all the time, every time, without having biases.

“We will leverage the expertise within our team to develop for them innovative and creative financing solutions. That means when they (clients) work with Sygnus, we’ll start with a blank sheet and let them paint their finance strategy (whether corporate or individual), and we’ll guide them and help them to achieve it — very different from other firms.

“We also understand the need for fiduciary responsibility and integrity. And so, even though we strive to be innovative and creative, we will always hold a high standard in terms of integrity and our fiduciary responsibility… We are thinking about working with our customers as long-term partners and to generate sustainable value.” Without these things, he notes, trust breaks down and this will have negative effects on results.

Source: Jamaica Observer